Your Guide Through 2025's Transformative Energy Landscape

Welcome to Flux Kinetics - Where Energy Meets Intelligence.

After more than a decade working as a leader in the energy industry’s operations and being also a technical analyst for the energy markets - from offshore execution to trading - I’ve observed a consistent gap: the disconnect between what’s actually happening in global energy systems and what reaches most stakeholders.

Whether you’re managing a portfolio, running operations, or making strategic decisions that depend on energy trends, you need analysis grounded in market fundamentals, not narratives.

That’s the mission behind Flux Kinetics. This newsletter delivers actionable intelligence on energy markets, combining rigorous analysis with practical insights you can actually use. We’ll cover everything from upstream oil and gas dynamics to renewable deployment economics, from geopolitical supply disruptions to the infrastructure buildouts reshaping electricity demand.

Whether you’re an industry veteran, institutional investor, corporate strategist, or policy professional, you’ll find analysis here that respects your time and intelligence. And yes, it’s completely free.

Let’s examine what defined 2025 as this year’s developments will shape market dynamics well into the next decade.

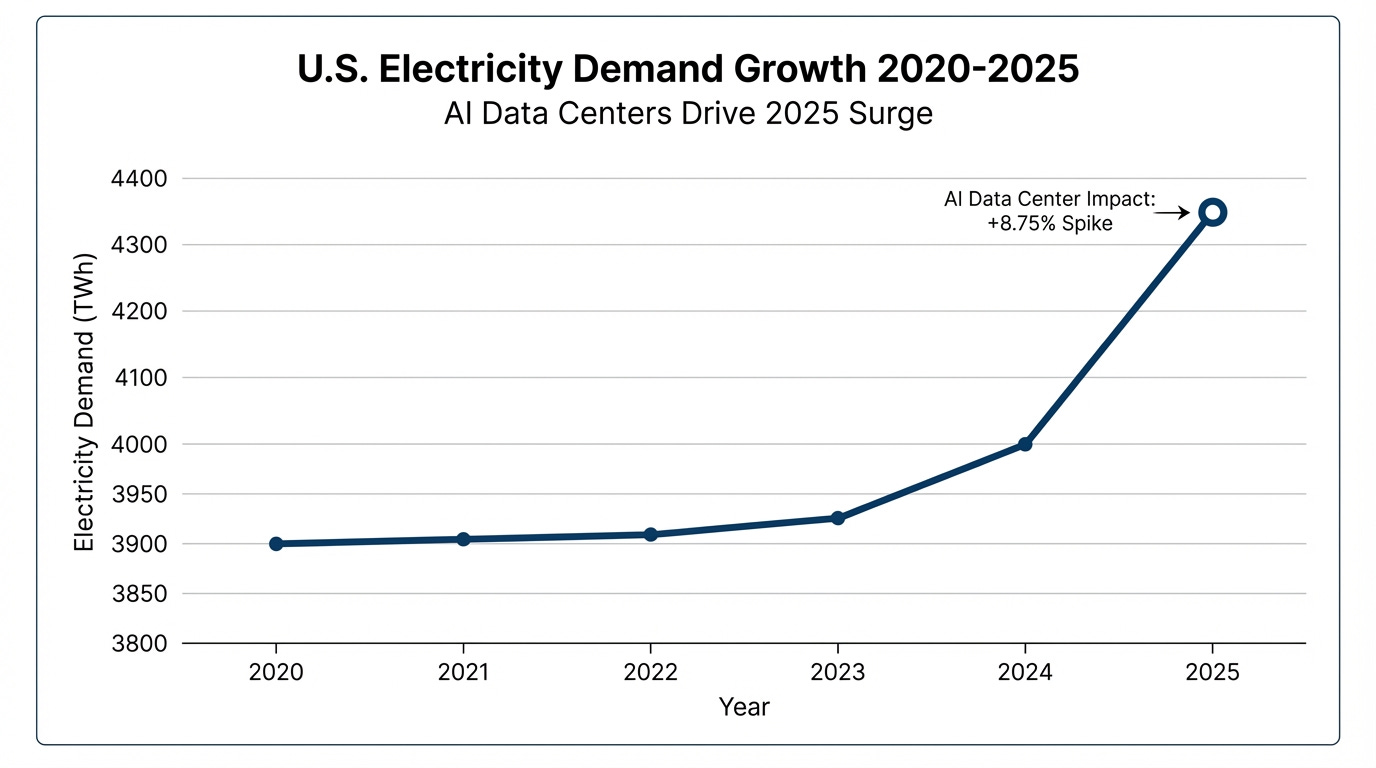

The Data Center Revolution Reshapes Power Markets

The most consequential energy story of 2025 wasn’t written in OPEC meeting rooms or climate conferences. It was coded in Silicon Valley and deployed across hundreds of data centers worldwide.

Artificial intelligence infrastructure emerged as the dominant driver of electricity demand growth across developed economies. The scale and velocity of this buildout caught even seasoned grid operators off-guard.

We’re seeing capacity additions that would normally unfold over years compressed into months. Each major AI facility consumes power equivalent to small cities.

The cascade effects have been significant: transmission constraints in key regions, wholesale power price appreciation, supply chain tightening for critical components. Most notably, there’s been a dramatic pivot toward natural gas as the dispatchable generation fuel of choice.

According to Forbes year-end analysis, this AI-driven demand surge represents “the gold rush of the 21st century.” It’s forcing fundamental reassessment of load growth assumptions across U.S. and OECD power markets.

The initial “build first, regulate later” phase appears to be ending. Policymakers are beginning to grapple with grid reliability and cost allocation questions.

For energy strategists, the implication is clear: electricity demand growth has returned after decades of efficiency-driven stagnation. And it’s being driven by a sector with deep capital and urgent timelines.

Oil Market Dynamics: OPEC+ Strategy Meets Shale Resilience

The crude oil market narrative in 2025 centered on a strategic gamble by OPEC+ that didn’t produce the intended results.

After years of disciplined production management, OPEC+ reversed course and added significant volumes back to global markets. The objective was straightforward: regain market share from relentless U.S. shale growth.

The outcome? Brent crude declined nearly 20% to approximately $60/barrel by year-end. Yet U.S. producers continued setting production records through multiple months.

This dynamic reinforces a critical lesson about North American unconventional production: its break-even flexibility and rapid cycle times create resilience that conventional producers consistently underestimate.

Looking ahead to 2026, we face what Reuters characterizes as potential “year of the glut” territory. The International Energy Agency’s latest projections show global supply exceeding demand by 3.85 million barrels per day, roughly 4% of global consumption.

OPEC’s research division offers a materially different view, forecasting a balanced market. This creates one of the widest analytical divergences in decades.

Market indicators suggest the IEA’s bearish case deserves serious weight. Floating storage and oil-in-transit volumes reached levels not seen since the April 2020 demand collapse. This signals that onshore storage capacity is approaching saturation.

For market participants, the setup entering 2026 favors buyers over producers, with inventory builds likely to keep price pressure persistent.

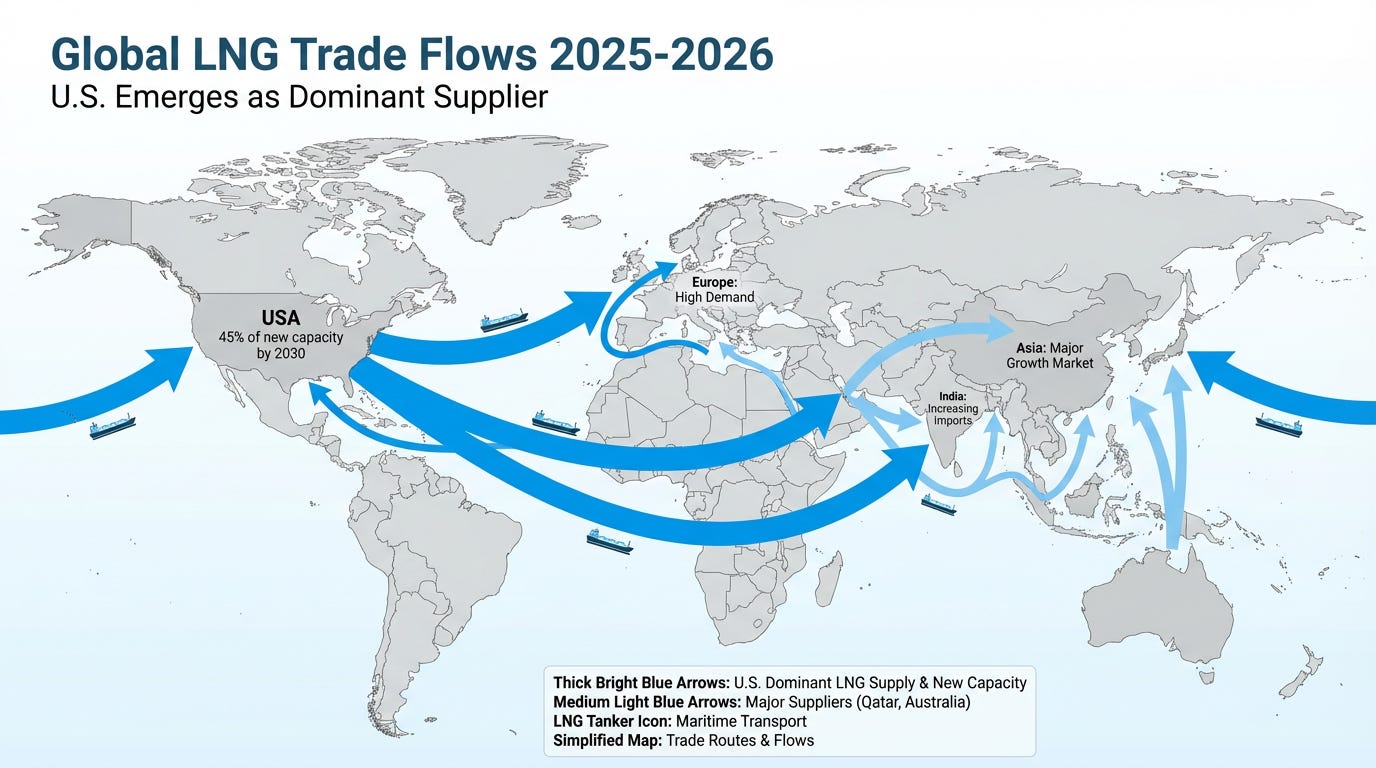

U.S. LNG Ascendancy Reshapes Global Gas Markets

The United States cemented its position as the world’s preeminent LNG supplier in 2025, a remarkable achievement considering the regulatory headwinds that persisted through the first quarter.

Despite a year-long federal permitting moratorium under the previous administration, U.S. LNG exports surged 25% year-over-year through September. The policy pivot on January 20th removed regulatory bottlenecks, and the industry responded with characteristic efficiency.

American LNG now holds a commanding lead over Australia and Qatar in export volumes. This fundamentally alters global gas trade patterns established over decades.

European buyers, still working to permanently replace Russian pipeline volumes lost since 2022, have become anchor customers for U.S. cargoes. This creates structural demand that extends well beyond near-term geopolitical tensions.

However, the supply-side picture is about to shift dramatically. According to IEA Analysis, global LNG export capacity will increase 50% between 2025 and 2030. The United States will contribute approximately 45% of that new capacity.

This represents roughly 300 billion cubic meters annually of additional supply coming to market.

The implications for 2026 and beyond are straightforward: producer margins will compress as supply growth outpaces demand growth. For buyers in Europe and Asia, this translates to improved negotiating leverage and potential cost relief.

The extraordinary margin environment of 2022-2024 is transitioning to a more normalized, buyer-friendly market structure.

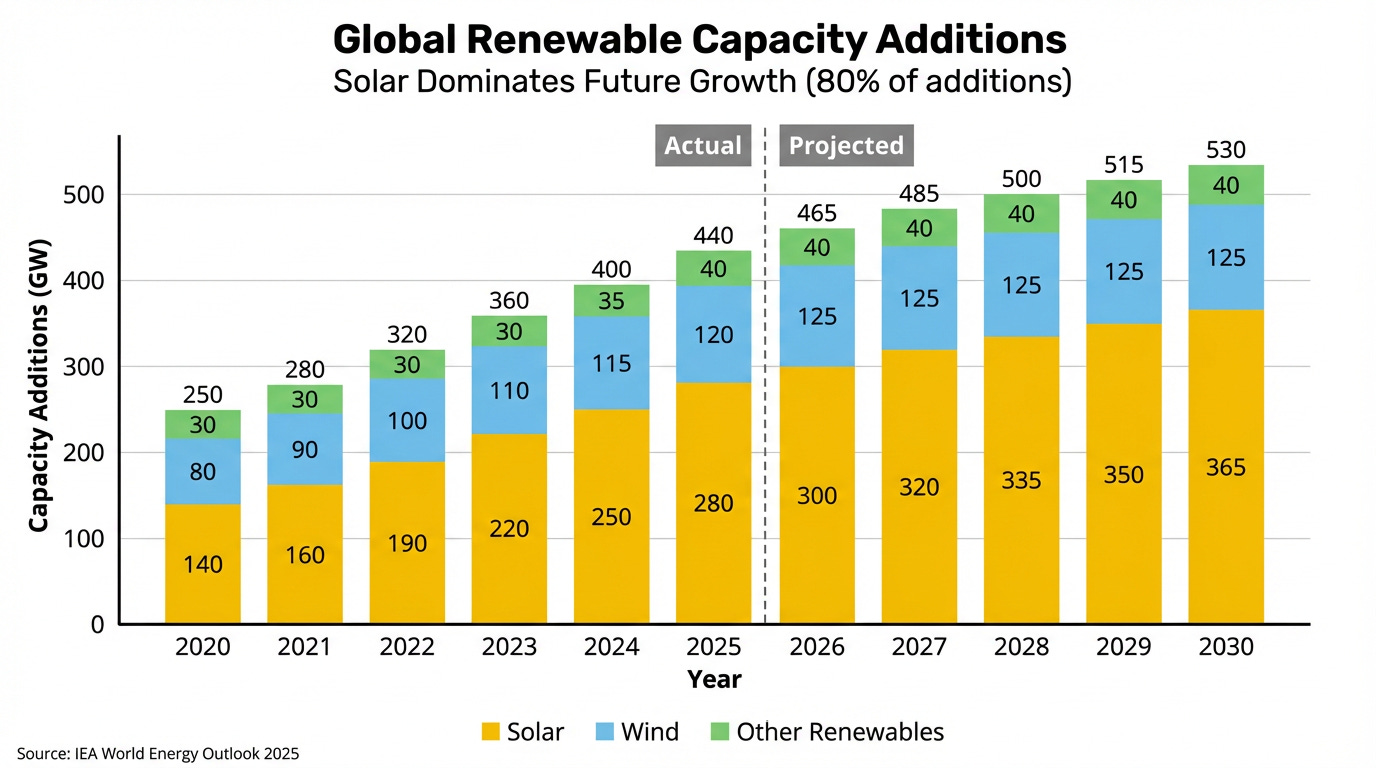

Policy Shifts Test Renewable Economics

The subsidy dynamics underpinning renewable energy deployment shifted fundamentally in 2025, creating new economic calculus for project developers.

The Inflation Reduction Act’s consumer incentives, particularly the $7,500 EV tax credit, terminated on September 30th. The market response was immediate and unambiguous: October and November saw precipitous declines in new electric vehicle sales.

Ford’s subsequent announcement of a $19.5 billion write-down on EV investments and portfolio restructuring underscored the challenge of scaling consumer adoption without subsidy support.

On the generation side, wind and solar project incentives entered phase-out, with a July 2026 construction deadline determining eligibility for benefits extending through end-2027.

Deloitte’s 2026 outlook projects these policy changes alone could increase solar project costs by 36-55% and onshore wind by 32-63% over the coming year.

Despite these headwinds, renewable capacity expansion continues albeit at a moderated pace. The IEA reduced its global renewable capacity forecast through 2030 by 20% versus prior projections. Yet it still anticipates 4,600 GW of additions by decade-end, with solar representing approximately 80% of new capacity.

The tension is instructive: electricity demand is growing 4% annually through 2027 (driven substantially by the data center buildout discussed earlier), while policy support mechanisms are being recalibrated.

This suggests markets rather than mandates, will increasingly determine deployment economics. That’s actually a healthier foundation for long-term investment, even if it produces more volatility in the near term.

Fossil Fuel Demand: Projections Meet Reality

The most significant analytical revision in 2025 came from an unexpected source: the International Energy Agency’s acknowledgment that fossil fuel demand trajectories are proving more durable than recent forecasts suggested.

In its November World Energy Outlook, the IEA confirmed that global consumption of oil, natural gas, and coal all achieved new records in 2025.

More significantly, the agency abandoned its recent projection that crude oil demand would peak before 2030. It replaced this with a base case showing continued demand growth through the decade.

U.S. natural gas exemplifies this trend. Both production and consumption reached historic highs in 2025, with recoverable supply increasing 16% to meet expanding domestic and international demand.

Despite widespread phase-out commitments, coal demand remained robust, particularly across developing Asian economies where energy access and industrial growth take precedence over emissions considerations.

This doesn’t negate the energy transition underway. Rather, it clarifies that we’re experiencing energy addition rather than energy replacement. Global energy consumption continues expanding, with new renewable capacity supplementing not yet substituting existing fossil fuel supply.

For strategic planning purposes, this distinction matters enormously. Assumptions about asset stranding timelines, investment payback periods, and transition velocities may need recalibration based on actual demand trajectories rather than aspirational scenarios.

Strategic Outlook: Key Themes for 2026

Several dynamics will likely dominate energy market conversations through the coming year:

Supply-side pressure across oil and gas: Both crude and LNG markets face potential oversupply conditions that will challenge producer economics and favor downstream consumers. Companies with strong balance sheets and operational efficiency will be positioned to weather - and potentially capitalize on - this environment.

Policy fragmentation: The coordinated approach to energy transition that characterized 2021-2024 is fragmenting as governments prioritize energy security and economic competitiveness alongside climate objectives. This creates more complex regulatory landscapes but also more diverse opportunities.

Infrastructure bottlenecks meet surging demand: The AI-driven electricity demand surge is colliding with transmission and generation constraints that take years to resolve. Expect continued focus on dispatchable generation, particularly natural gas and increasingly nuclear.

Products market divergence: While crude faces oversupply risks, refined products particularly diesel, have shown surprising strength due to Russian refinery disruptions and European import restrictions. This divergence may persist through 2026.

Critical minerals competition intensifies: China’s rare earth export restrictions triggered strategic responses across Western economies to diversify supply chains. This “friend-shoring” acceleration will reshape mineral flows and create opportunities in previously marginal deposits.

Building This Community Together

We’re entering 2026 with oil markets facing potential gluts, LNG capacity expanding rapidly, AI infrastructure straining electricity systems, subsidy regimes shifting, and fossil fuel demand proving more resilient than many projected.

Complex? Certainly. But complexity creates opportunity for those with clear-eyed analysis.

That’s what Flux Kinetics delivers every week: rigorous market analysis drawing from authoritative sources including Reuters, IEA, EIA, and primary industry data. No ideological bias. No promotional agendas. Just the information you need to make informed decisions.

I invite you to subscribe : it’s Completely Free. You’ll receive weekly insights covering market fundamentals, policy developments, and strategic implications across the energy spectrum.

If you find value in this analysis, please share Flux Kinetics with colleagues, partners, or anyone in your network who needs sophisticated energy market intelligence.

The decisions our industry makes in the coming years will shape economic and environmental outcomes for decades. Better decisions require better information.

Let’s navigate this landscape together.

Flux Kinetics - Where energy meets intelligence,

Wassim C.

This content is for educational purposes only and does not constitute financial, legal, or tax advice. All opinions and analyses are my own, and any actions you take are at your own risk after consulting an appropriate professional.