Venezuela's Oil Equation Just Changed : Here's What Energy Markets Are Missing

World's largest reserves might not rescue oil prices

The weekend capture of Venezuelan President Nicolás Maduro by US forces has sent a ripple through energy markets, but not the wave most anticipated. While gold jumped and geopolitical risk premiums briefly spiked, oil prices actually declined. Brent crude slipping below support levels even as one of OPEC’s founding members faces wholesale political restructuring. If you’re tracking energy portfolios or advising on policy implications, that counterintuitive price action tells you everything about where this story is headed.

The real question isn’t whether Venezuela matters to global oil supply. With current production hovering around 800,000 to 1 million barrels per day, less than 1% of global output, the immediate supply disruption is negligible. What matters is the long game, and right now, the math doesn’t favor bulls expecting a quick recovery that props up crude prices.

The Reserve Paradox: Massive Potential, Minimal Impact

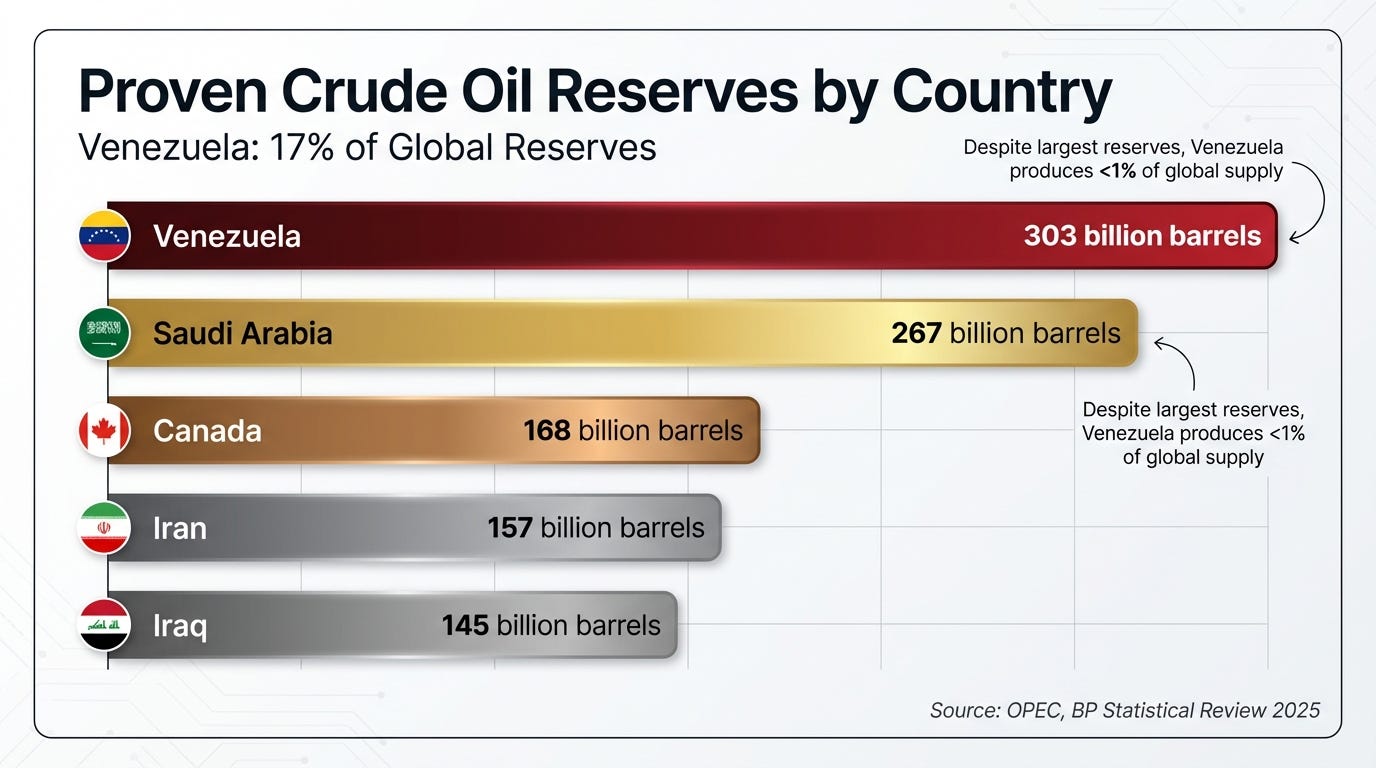

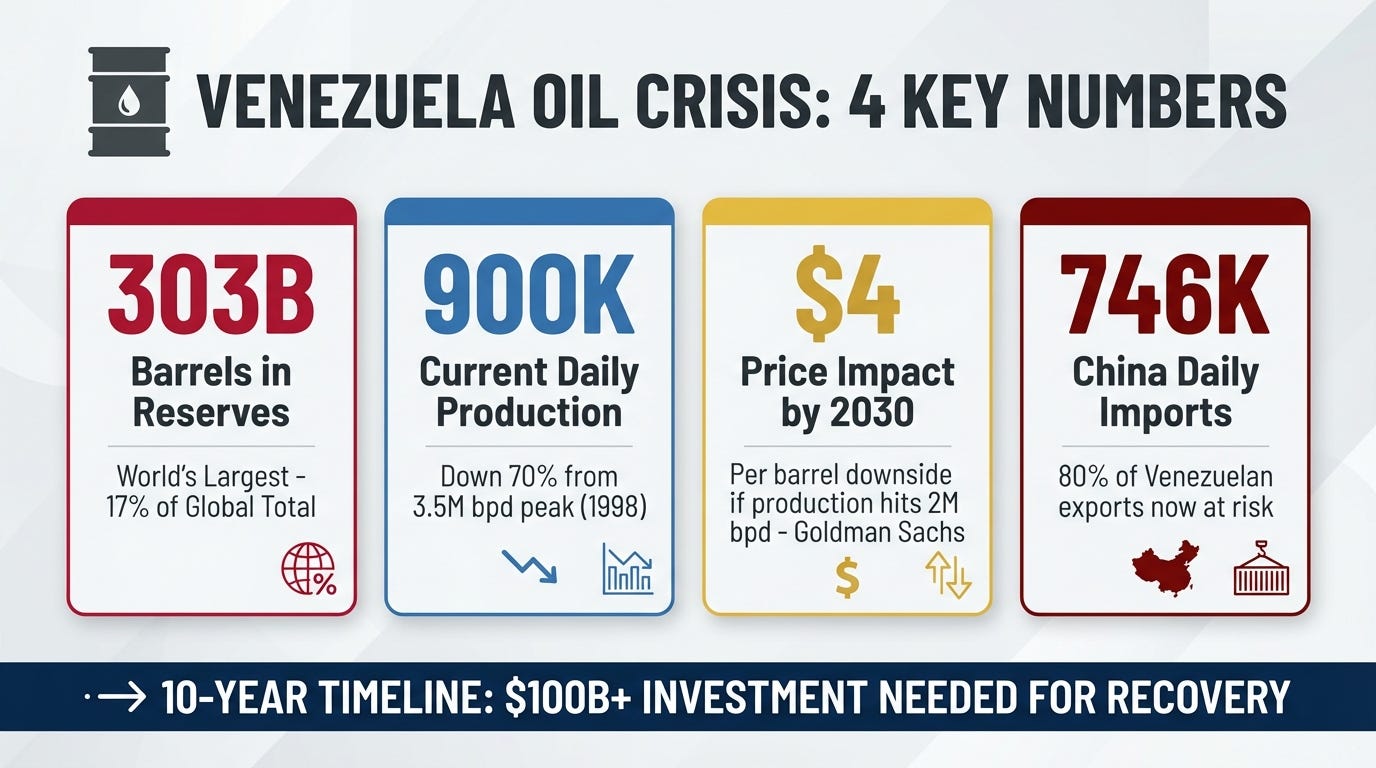

Venezuela sits on 303 billion barrels of proven reserves, the largest in the world, exceeding even Saudi Arabia’s holdings and representing roughly 17% of global proven reserves. For context, that’s more crude underground than Russia and the United States combined. Yet despite this geological windfall, the country currently produces roughly the same daily volume as Romania.

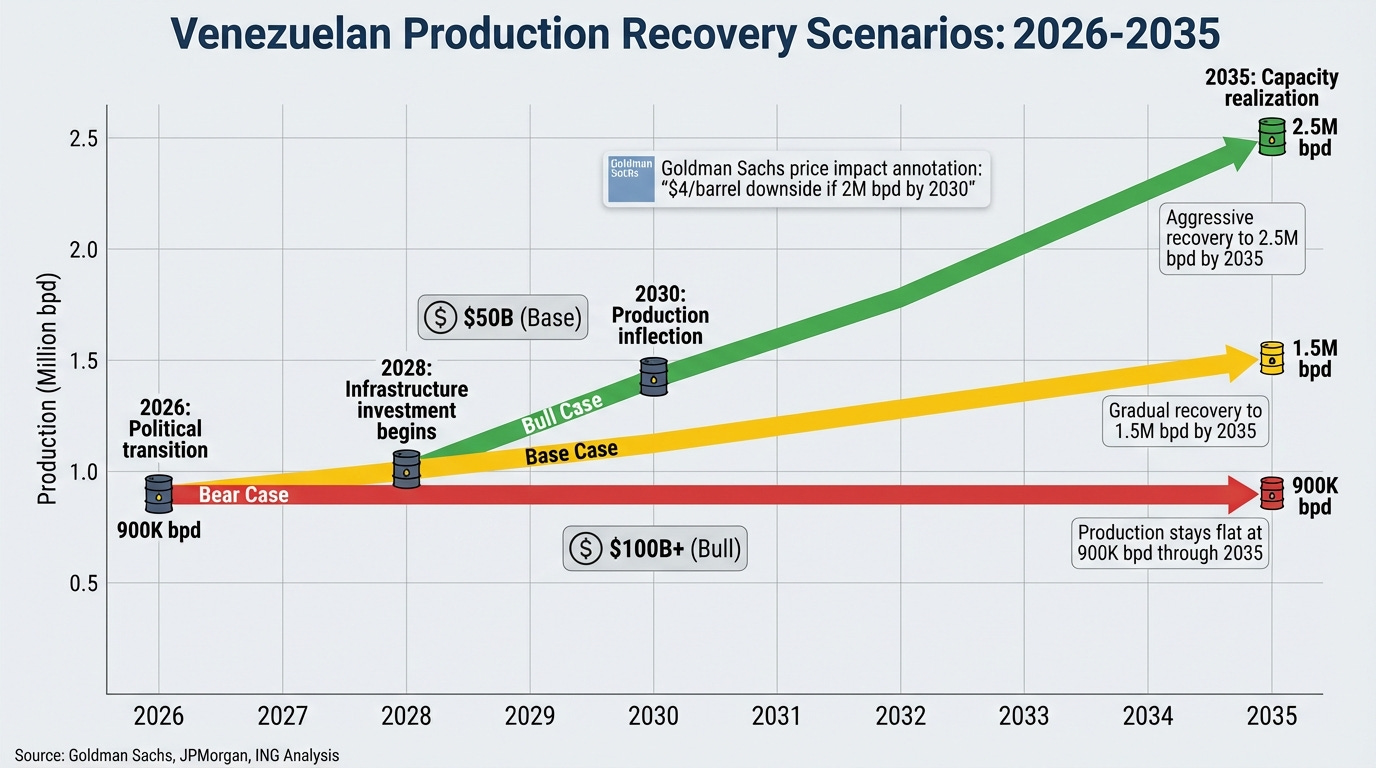

The gap between reserve potential and production reality defines why energy investors should approach Venezuelan exposure with caution rather than enthusiasm. JPMorgan analysts project Venezuela could scale production to 2.5 million barrels per day over the next decade requiring an estimated investment exceeding $100 billion and political stability that hasn’t existed since the late 1990s.

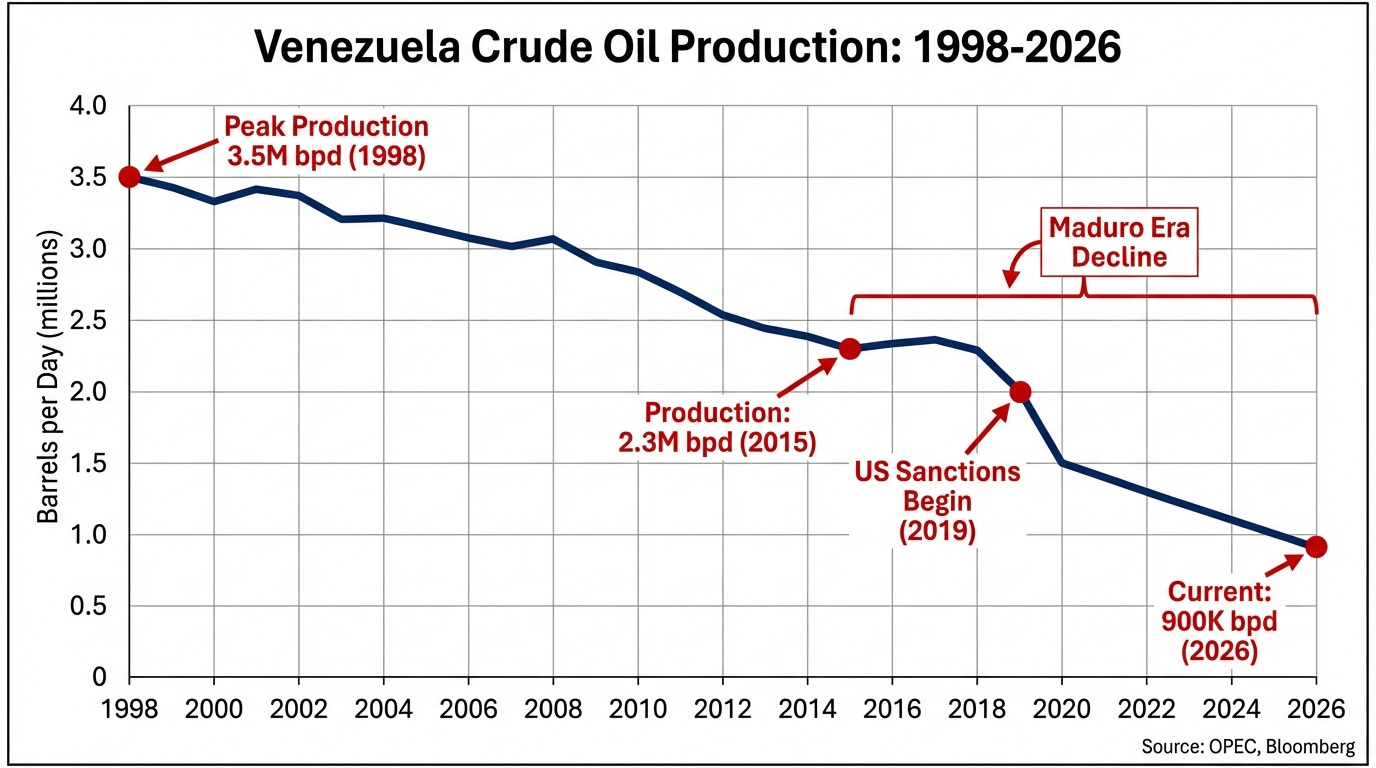

The production collapse tells the real story. From a peak of 3.5 million barrels per day in 1998, Venezuela’s output has cratered by more than 70%, a decline unprecedented among major oil producers outside of active war zones. Decades of mismanagement, underinvestment, corruption, and sanctions have turned the world’s largest oil reserves into one of its least productive assets.

Short-Term Dynamics: Why Markets Yawned at Geopolitical Shock

The muted market response tells a supply-side story. US sanctions and naval blockades had already constrained Venezuelan exports to roughly 500,000 barrels per day in December 2025 (half the November level )with flows grinding to a near standstill since January 1st. State oil company PDVSA has begun cutting production rather than expanding it, shutting down oilfields as onshore storage capacity maxes out with crude that can’t reach export markets.

This isn’t a new supply shock, it’s the continuation of an existing one, now potentially shifting from constriction to eventual expansion. Fund managers pricing in geopolitical risk premiums are asking the wrong question. The relevant scenario isn’t “What happens if Venezuelan supply gets disrupted?” It already is disrupted. The scenario that matters: “What happens if Venezuelan supply actually recovers?”

Goldman Sachs quantified that answer: in a scenario where Venezuela scales production to 2 million barrels per day by 2030, they estimate $4 per barrel downside to oil prices through that period. For energy funds positioned long on oil futures or commodity indices, that’s not a tail risk : it’s a structural headwind hiding in plain sight.

Goldman’s 2026 forecast for Brent remains anchored and unchanged despite weekend events at $56 per barrel, with WTI at $52. Translation: the world’s most sophisticated energy trading desks see Venezuelan developments as neutral to bearish for crude, not bullish.

The China Variable: Financial Exposure vs. Supply Exposure

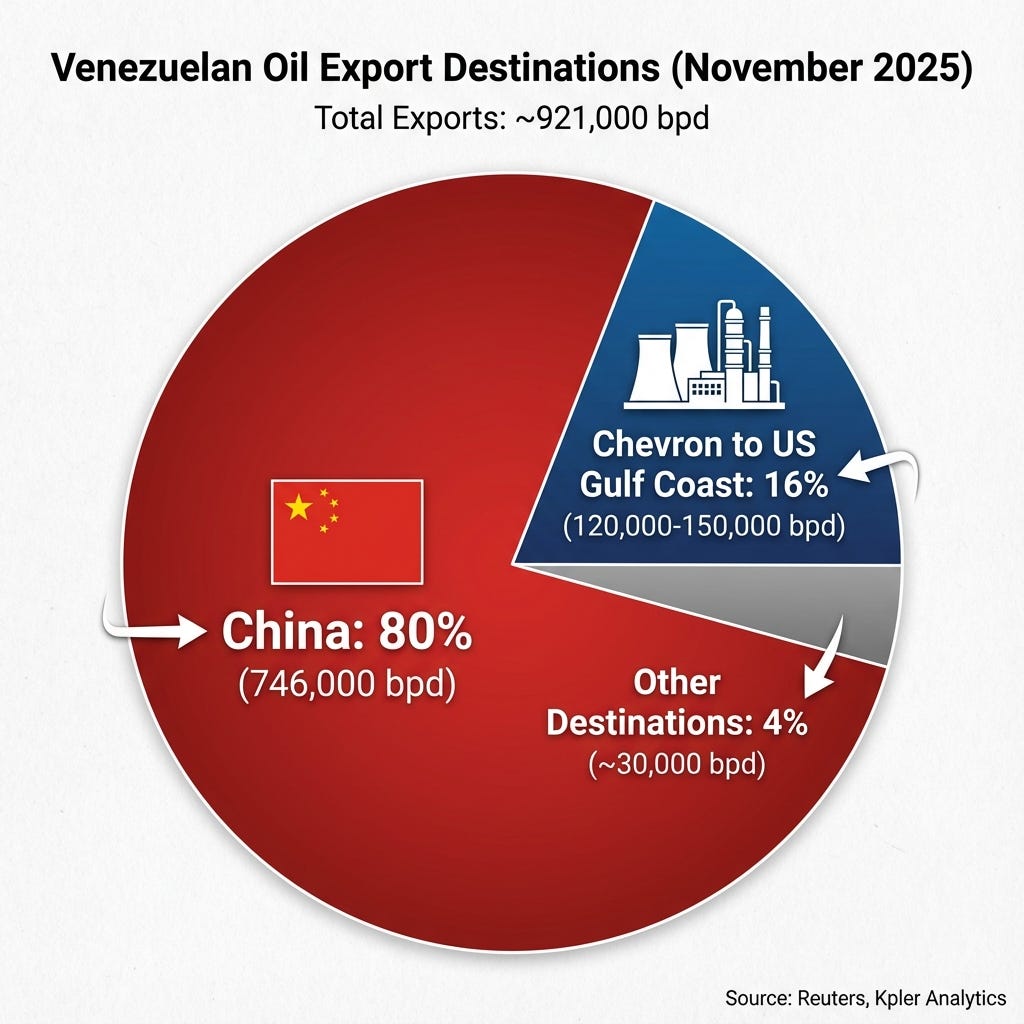

Before US intervention, China absorbed approximately 746,000 barrels per day of Venezuelan crude, 80% of total exports. That heavy, sulfur-rich crude feeds Chinese “teapot” refineries and bitumen production for infrastructure projects, creating specialised demand that can’t easily pivot to alternative suppliers.

But here’s what energy investors watching Asian markets need to internalize: Venezuelan supply represents only 4% of China’s total oil imports. The bigger Chinese exposure isn’t volumetric, it’s financial. China holds approximately $19 billion in outstanding oil-backed loans to Venezuela, debt instruments now facing dramatic repricing as the political landscape shifts.

For emerging market debt funds and commodity-linked sovereign exposure, Venezuelan debt restructuring risk just moved from theoretical to imminent. Energy policy analysts should note the precedent this sets: oil-backed bilateral loans, increasingly used by resource-rich nations to secure financing from China, now carry demonstrated counterparty risk that extends beyond geology and production capacity into regime stability.

US Refinery Economics: The Gulf Coast Angle

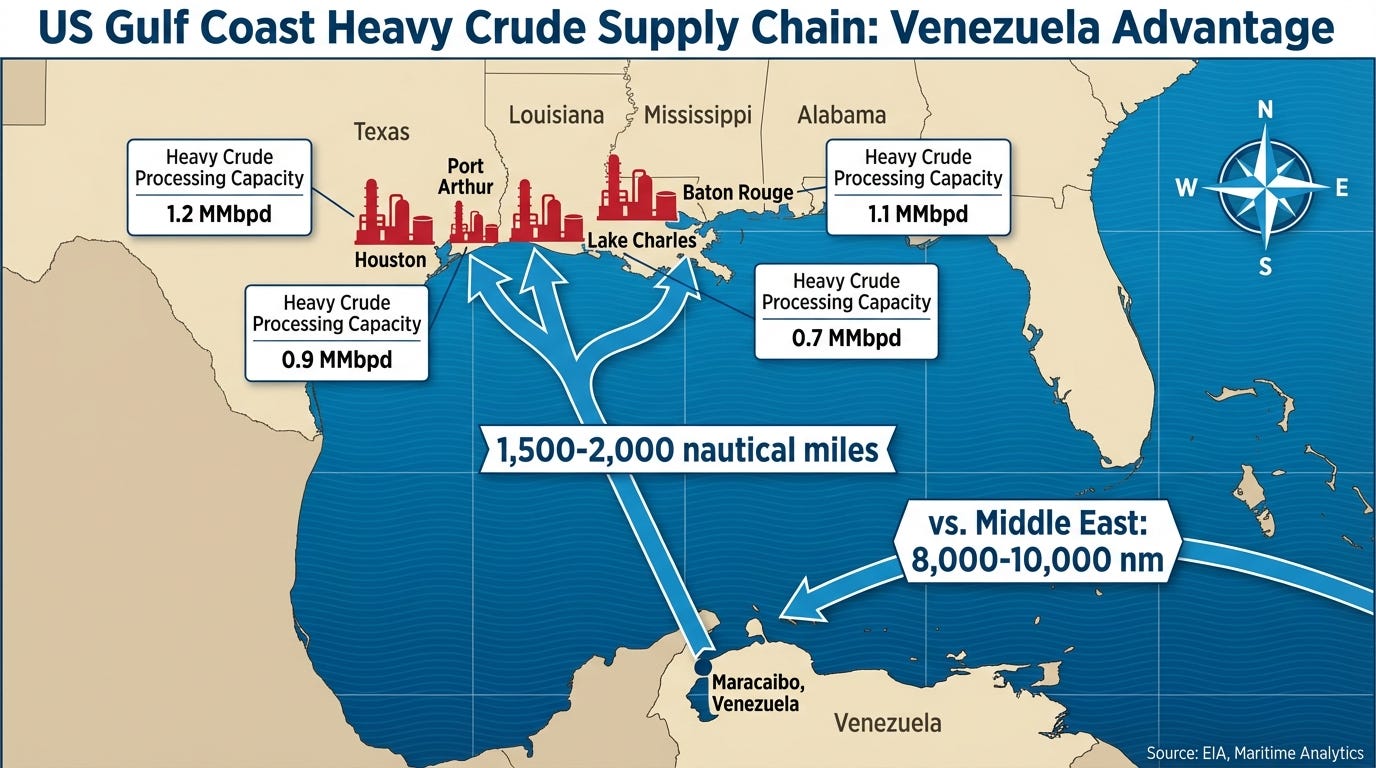

While most market commentary focuses on production volumes, sophisticated energy investors are watching a different angle: US Gulf Coast refinery margins. These facilities were engineered decades ago to process exactly the type of heavy, sulfur-rich crude Venezuela produces. With Canadian heavy crude facing pipeline constraints and Mexican production in secular decline, Venezuelan barrels represent margin accretive feedstock for refiners like Valero, Marathon, and Phillips 66.

Chevron, the only US major currently operating in Venezuela under Treasury Department waiver, ships approximately 120,000 to 150,000 barrels per day to Gulf Coast refineries. That’s a rounding error in global terms but a significant margin input for specific refining assets optimized for heavy crude processing. The geographic advantage is substantial: Venezuelan crude reaches Gulf Coast refineries in 1,500-2,000 nautical miles compared to 8,000-10,000 nautical miles from Middle Eastern suppliers.

If sanctions unwind and Venezuelan flows to US refineries normalize, still a significant “if” given infrastructure decay and investment requirements, expect refining margins in the Gulf Coast to compress as feedstock costs decline. That’s a net positive for US fuel consumers and energy security metrics but creates a headwind for refinery equities that have benefited from tight heavy crude differentials.

What This Means for Portfolio Positioning

Energy fund managers tracking this space should recalibrate expectations around three timeline scenarios:

Near-term (Q1-Q2 2026): Minimal supply impact. Venezuelan production likely decreases further as political transition creates operational uncertainty. Any geopolitical risk premium in oil futures is a sell opportunity, not a structural shift. Goldman, JPMorgan, and ING all maintain bearish-to-neutral crude forecasts through 2026 unchanged.

Medium-term (2026-2028): Political and operational clarity emerges. If an orderly transition occurs and sanctions unwind systematically, expect modest production increases reaching 100,000 to 200,000 bpd annually. This represents gradual bearish pressure on crude but insufficient volume to materially shift global balances while OPEC+ maintains production discipline.

Long-term (2028-2035): The structural supply risk materializes. If $50-100 billion in investment flows into Venezuelan infrastructure, requiring both political stability and attractive fiscal terms for international oil companies, production could scale toward 2-2.5 million bpd. That volume, entering a market already facing demand headwinds from electrification and efficiency gains, creates persistent downward pressure on crude prices.

Policy Implications: Energy Security vs. Market Stability

For government analysts and policymakers tracking energy security, Venezuela presents a classic tension between strategic objectives and market outcomes. Restoring Venezuelan production enhances Western Hemisphere energy independence and reduces Chinese influence in Latin American energy markets. But that same supply restoration undermines oil prices, potentially destabilizing US shale economics if sustained Brent prices drop toward $50 per barrel.

The US shale breakeven curve has compressed dramatically, but below $50 Brent, marginal Permian producers face economic pressure. Policymakers who view energy dominance through the lens of production volumes may inadvertently create price dynamics that constrain US shale growth, the very sector that delivered American energy independence over the past decade.

Energy security doesn’t always align with energy industry profitability. Venezuela is about to remind us why.

The Takeaway: Fade the Hype, Watch the Fundamentals

The weekend’s geopolitical drama makes for compelling headlines, but energy markets already priced in the substance weeks ago when sanctions tightened and Venezuelan exports collapsed. What hasn’t been fully priced: the long-term supply potential if political and operational conditions stabilize.

For investors holding energy exposure through ETFs, commodity futures, or integrated oil majors, Venezuelan developments tilt long-term supply dynamics bearish, not bullish. The 303 billion barrels underground aren’t coming online quickly, but they’re real. And in a world where demand growth faces structural headwinds from efficiency and electrification, future years additional supply matters for valuation models built on sustained undersupply.

For policymakers balancing energy security objectives with market stability, Venezuela offers both opportunity and complication. Reduced Chinese energy influence in the Western Hemisphere advances strategic goals. But flooding markets with additional heavy crude supply undermines price stability that US producers depend on for capital deployment

The professionals tracking geopolitical risk in energy markets know that Venezuela’s story isn’t written in days or weeks as it unfolds over quarters and years. Those positioning portfolios and policy for that longer arc, rather than reacting to weekend headlines, will navigate this transition with clearer perspective on what actually moves markets versus what merely moves media cycles.

Thank you for taking the time to read Flux Kinetics; your engagement is genuinely appreciated. If you find this analysis valuable, please consider sharing it with your network, subscribing, and adding your comments, feedback, or suggestions so that future editions can be further improved for you.

Flux Kinetics - Where energy meets intelligence,

Wassim C.

This content is for educational purposes only and does not constitute financial, legal, or tax advice. All opinions and analyses are my own, and any actions you take are at your own risk after consulting an appropriate professional.